NAVF Pharma’s cannabis fund is accepting Bitcoin as a Payment Method up to $50M of its capital raise.

FORT LAUDERALE, FLORIDA (February 17, 2020) – Bitcoin and the cryptocurrency markets are suddenly in a rebound, with Bitcoin having a global market value of $60 Billion. At the same time, US Cannabis investments have lost nearly $50 Billion in market value. Publicized in recent headlines, the cannabis marketplace has been plagued by a combination of inflated acquisitions, inexperienced executive management, regulatory issues, safety concerns, and questionable processing practices. In addition, several lawsuits are being led by numerous investors, regarding overstatement in profits, insider trading, securities violations, stock manipulation, and outright fraud according to various court filings and industry insiders. Whereas, most cannabis companies are attempting to treat the dozens of symptoms that deplete the cash reserves and would-be investors distributions, E.g. Federal Tax Code, such as IRS rule 280e, which taxes 100% of a cannabis companies’ revenues, without the benefit of any tax deductions.

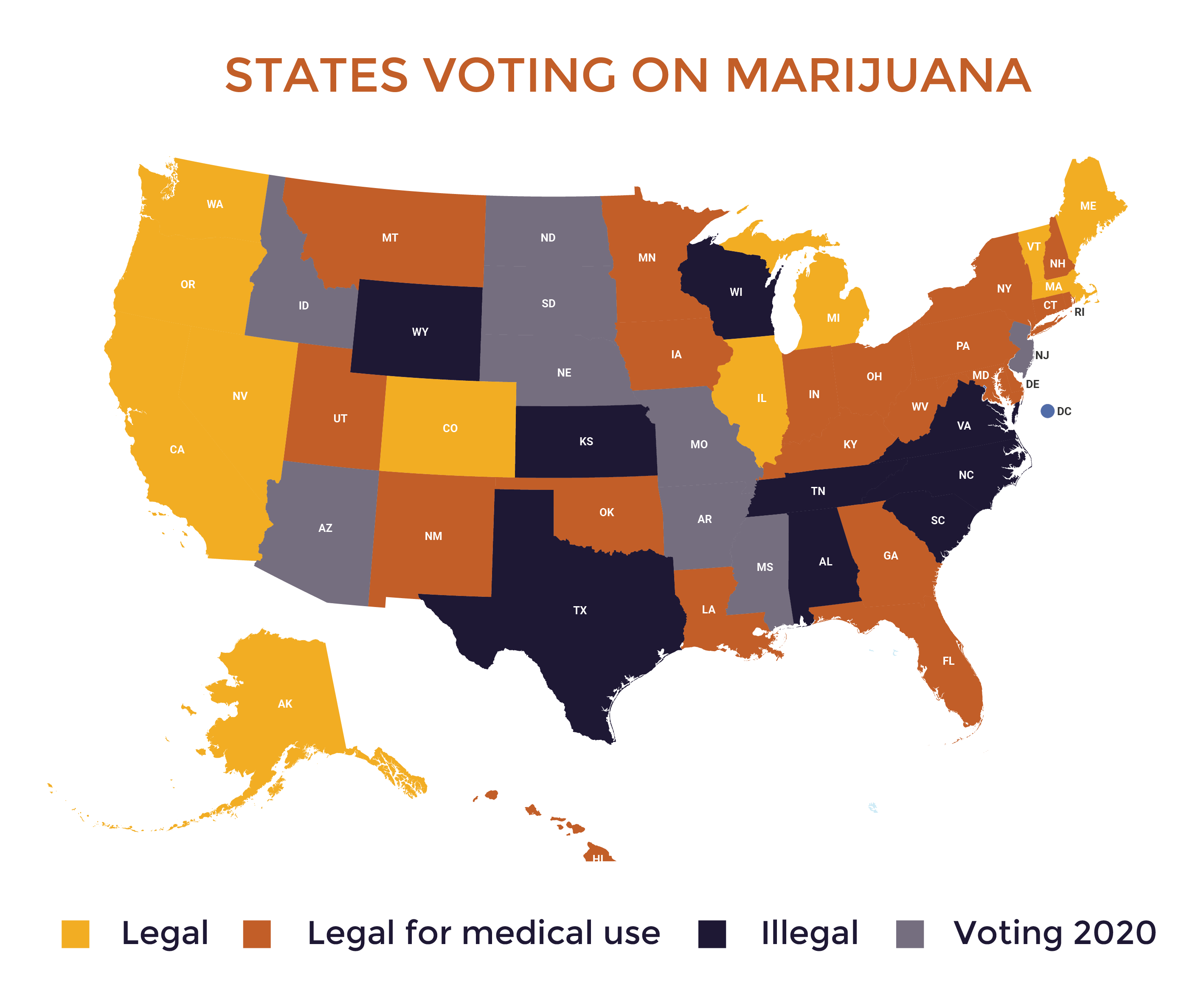

Given the current industry, losses have placed the cannabis industry in chaos, NAVF Pharma’s Cannabis Fund sees the perfect opportunity for market entry as the Cannabis sector attempts to regain its footing. One of NAVF Pharma’s first disruptors among many is the acceptance of Bitcoin for the company’s stock within its General or Limited Partnerships. According to a majority of industry analysts, there is still a huge market opportunity. In North America, the legal cannabis market amounted to $12 billion in 2018, growing by nearly 30% percent on the year. The largest market was the United States, which totaled $10.4 billion. It was followed by Canada with $1.6 billion. Analysts predict the overall Cannabis market for legal adult-use and medical sales in North America will reach $24.5 Billion by 2021 with the compound annual growth rate (CAGR) to almost 28%, according to Arc View Market Research and BDS Analytics.

So, with this much revenue growth, why are investors losing on average 40.8% per annum in the value of their investment, which was reported by Pitchbook and validated by other industry datasets? John Cataldi, Co-Managing Partner or NAVF responded to this question at a Miami private cannabis investor gathering by saying,” The first step in solving any problem is recognizing there is one, differentiate fact from opinion, test, then implement the solution, retest, re-implement”. Over the past 24 months, NAVF Pharma has been building its business model (including the acceptance of Bitcoin), selecting acquisition targets, building intellectual property, creating formulations of the highest quality Cannabis-based products, conducting competitive and customer product interviews while waiting for the right market conditions to come out of its stealth mode in order to make their entry into to Cannabis market. “We are not the typical cannabis company, there are plenty of risks in this industry, from a huge Federal taxation rate, a sea of regulatory laws, banking, product liability, product quality assurance, the establishment of product safety protocols to name a few. We understand the problems, and we believe we have solved many of the issues facing the industry today”, explaims Cataldi. He adds: ”One of the solutions lies in blockchain technology. Yes, legally accepting cryptocurrency is novel, but it’s probably the least of our disruptions we are bringing into the marketplace that includes not just payments, but utilizing the power of blockchain for product tracking, patient history and so much more. The Cannabis industry, like Bitcoin, is here to stay, and for all those Bitcoin holders looking to place a foot firmly in the market, we look forward to taking that journey together”.

“The announcement of NAVF Pharma’s Cannabis Fund taking Bitcoin, their entry into the market given their unique business model in working with Native American Tribes is definitely a huge disruptor to the status quo”, states Dr. Leonard Mills, Economist and Verte Funds Managing Principal, having a significant history of successful exits within the Cannabis and seeing the value add of Blockchain. He adds: “Whereas many major Cannabis operators are laying off workers, selling assets, and reorganizing, NAVF Pharma has provided the platform for Bitcoin holders to invest and take advantage of the current cannabis market vulnerabilities”. Dr. Mills concludes: “Our mission is to continue to create high investor returns while mitigating taxation through our fund’s structured investments like NAVF. Ultimately our funds create immense investor and community value”.

Brent Hill, Co-Managing Partner and CFO of NAVF expressed that: “We are very proud of our team that created a solid platform which will allow them to accept Bitcoin purchases of its Securities with a minimum current purchase price of ₿ 103.66 to 5,183.49” (the equivalent settlement value of the transaction as $1,000,000 – maximum of $50,000,000 USD). Mr. Hill adds, “The company has previously been approached by several holders of Bitcoin that wanted to invest in the Cannabis industry, met the accreditation standard for investment, but for a number of reasons from potential taxation to illiquid existing holdings, desired to use cryptocurrencies as a means of payment. NAVF Pharma worked closely with its legal team over the past quarter to create a white hat, a financial platform that will protect both the company and the investor in concluding stock acquisition, using cryptocurrency without running afoul of existing US regulations”.

If you are a Bitcoin holder or a Bitcoin Holder’s representative and you would like to utilize your Crypto Currency as a means to purchase equities from NAVF’s Pharma’s cannabis fund, please visit our website www.NAVFPharma.com/CryptoInvest to learn more.

About NAVF Pharma

NAVF Pharma is a series of socioeconomic development impact investment funds that promote Environmental, Social and Governance (ESG) development activities for indigenous tribes throughout North America. NAVF Pharma’s mission is to create economic sustainability, job creation, and an educated workforce, while adhering/respecting the culture of the tribe, its people, and the environment. NAVF’s Pharma focuses on various holistic disciplines within the Pharma-Cannabis sector. NAVF Pharma is an EEOC employer with hiring preference to indigenous applicants under Section 703(i) of Title VII.

For more information, visit www.NAVFPharma.com or contact:

Brent Hill, Managing Director, Native American Venture Fund

2598 E Sunrise Blvd. Suite 2104 Fort Lauderdale, FL 33304

Phone: 754-301-8843 Email: [email protected]

www.linkedin.com/company/navf-pharma

About Verte Opportunity Fund

Verte Opportunity Fund, the second fund managed by Dr. Leonard Mills, is a qualified opportunity fund investing in high-growth, small-business impacting Opportunity Zones.

The Verte OZ Fund aims to have a positive social impact, grow the entrepreneurial ecosystem, and provide attractive returns for investors. Ultimately, the Verte OZ portfolio will be diverse and comprised of approximately 50 small companies nationwide, of which cover a wide range of maturities and expected exits. Unlike most Opportunity Zone Funds, Verte OZ is designed to appeal to a broad array of investors, including those with realized capital gains, tax-advantaged (IRA), and taxable investments. Verte Opportunity Fund is currently open to investors who are interested in taking part in impactful venture capital opportunities.

For more information:

Natalie Elder

Investor Relations and Outreach