In North America, the legal cannabis market amounted to $12 billion in 2018, growing by 30 percent on the year. The largest market was the United States, which totaled $10.4 billion. It was followed by Canada with $1.6 billion. Analysts predict the overall cannabis market for legal adult-use and medical sales in North America to reach $24.5 billion by 2021 with the compound annual growth rate (CAGR) to almost 28%, with the recreational cannabis market will cover about 67% of the spending while medical cannabis will take up the remaining 33%[1].

Legal adult-use and medical sales in North America to reach $24.5 billion by 2021, at a compound annual growth rate (CAGR) to almost 28%, with Leglization decreasing illicit acquisition and accelerating market revenues.

BDS ANALYTICSBDS ANALYTICS, Q4 2018 US CANNABIS OUTLOOK

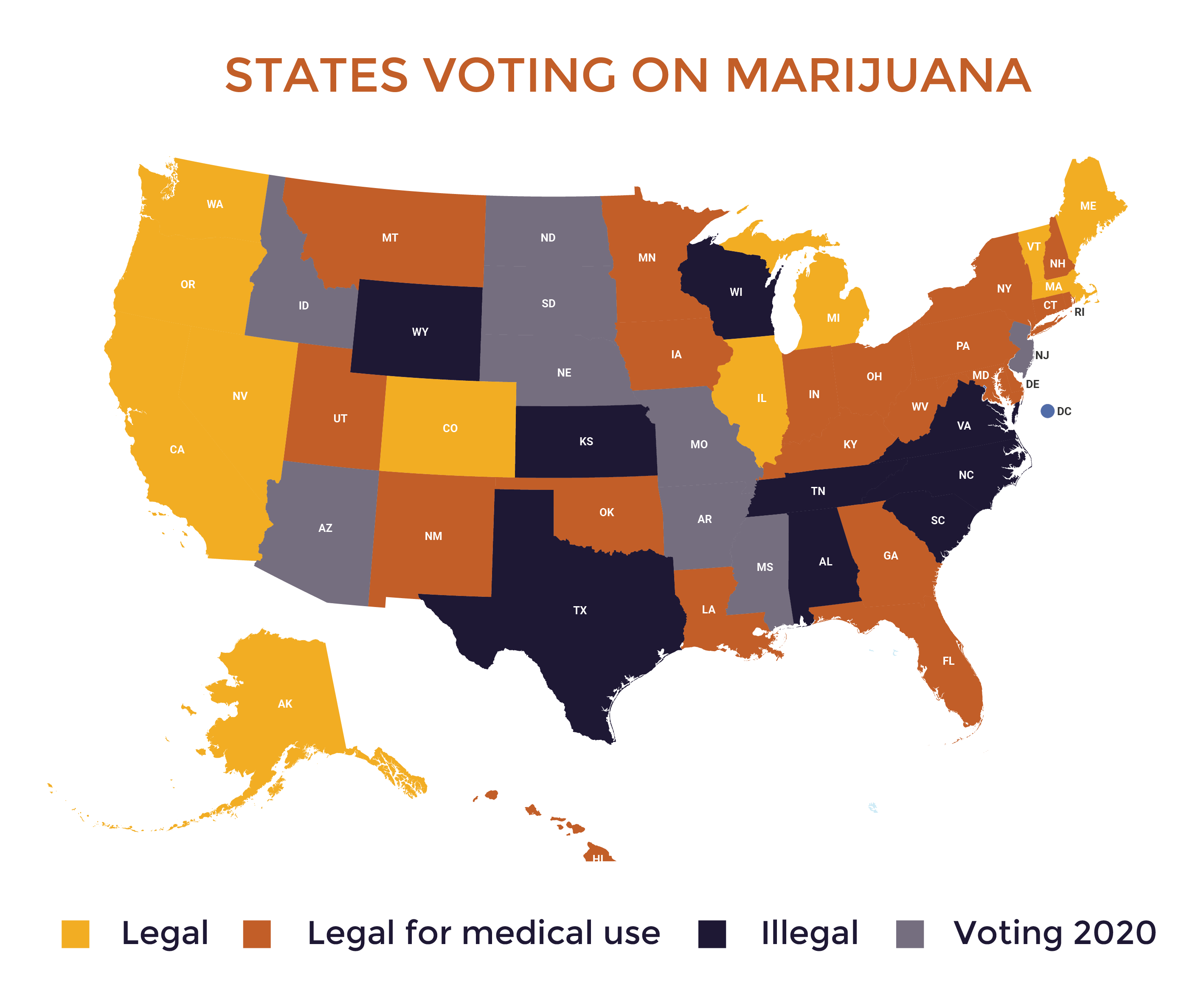

In 2018, 62% of Americans reported supporting cannabis legalization, double what it was in 2000 (31%)[2]. Although the use of cannabis is illegal under federal law and the federal government classifies cannabis as a schedule 1 drug[3]. Most states legalized cannabis only for medical purposes, but ten states – Alaska, California, Colorado, Maine, Michigan (2018), Nevada, Massachusetts, Oregon, Vermont, and Washington – have gone further, legalizing recreational use.

For high THC containing CBD oils, also referred to as full spectrum[4], Georgia, Alabama, and Tennessee, amongst other states, are in the process of issuing licenses for medicinal full-spectrum products. The market for full-spectrum CBD oils is inclusive in industry market data and projections.

In relation to CBD sales, by 2024, California is expected to be the largest CBD market in the United States, with sales reaching over 3.3 billion U.S. dollars. Florida and New York would round out the top three with sales of 1.8 billion and 1.5 billion respectively[5]. According to Cabaccord Genuity, a Global Equities Research firm, the demand for CBD products is experiencing strong growth, will accelerate market demand following the recent passage of the 2018 Farm Bill[6].

Comparatively, about $620 million worth of CBD products were sold during 2018 in the United States (based on 706% growth to $5 billion). Growing CBD revenue from about $620 million in 2018 to $23.7 billion by 2023 calculates to a compound annual growth rate (CAGR) of 107%. The catalyst in the massive five-year growth spurt is the implementation of the 2018 Farm Act, which legalized hemp-derived CBD, the movement of big pharma in their aggressive marketing of CBD derived drugs, and continued growth of the medical cannabis industry within US states. In addition, general retailers, to include big pharmacy chains such as CVS Health, in March 2019 announced plans to carry CBD topicals in approximately 800 stores across eight states. Walgreens Boots Alliance followed CVS just days later by announcing its intention to carry CBD topicals in 1,500 stores in a handful of states. Rite Aid is currently doing test markets of CBD topicals in Washington and Oregon. National grocery chain Kroger recently announced plans to carry CBD items in 17 states, with Harvest Health & Recreation announced a game-changing partnership to supply CBD products to at least 10,000 gas-station convenience stores[1].

Key Takeways:

- With a successful entry of Big Retail and Pharma, U.S. CBD Sales are estimated to grow an average of 107% annually through 2023.

- It is estimated that US CBD sales will deliver a dramatic 107% CAGR to $23.7B by 2023.

- US states, with robust legal cannabis markets, should see a disproportionately high share of this demand.

- Competition is rising across the supply chain with the entry of mainstream Consumer Package Goods (“CPG”) and mass retail.

Page Sources:

[1] ArcView Market Research and BDS Analytics, Q4 2018 US Cannabis Outlook

[2] Pew Research Survey, Oct 2018 http://www.pewresearch.org/fact-tank/2018/10/08/americans-support- marijuana-legalization/

[3] Under the Controlled Substances Act, all controlled drugs fall under five schedules. Schedule I has the highest level of control, designated a substance as having no safe medical use and has a high risk of abuse or misuse. Schedule I substances are illegal under the law.

[4] Full Spectrum is defined as cannabis products above the legal limit of .3% tetrahydrocannabinol (THC) a naturally occurring psychoactive compound within the cannabis plant) are among, which would be considered a schedule 1 drug under federal guidelines and illegal to grow, manufacture or distribute, unless authorized by the State.

[5] Understanding CBD’s tremendous growth potential 2019, Canaccord Genuity September 2019

[6] 2018 Farm Bill de-scheduled Hemp derived CBD from a Schedule 1 drug, and illegal to possess, to legal.

[7] Harvest Health & Recreation Signs Landmark Agreement to Distribute CBD Products to More than 10,000 Retail Stores Across the U.S., Berkshire Hathaway – Business wire June 2019.